Federal Tax Brackets 2025 Married. +more all taxes filing for free best tax software best tax software for small businesses tax refunds tax brackets tax tips taxes by state tax payment. Seniors over age 65 may claim an additional standard deduction of $1,950 for single filers and $1,550 for joint filers.

As your income goes up, the tax rate on the next layer of income is higher. Seniors over age 65 may claim an additional standard deduction of $1,950 for single filers and $1,550 for joint filers.

Knowing your federal tax bracket is essential, as it determines your federal income tax rate for the year.

Instead, the irs assigns your income to brackets with tax rates that increase as you earn more money.

2025 Tax Brackets Vs 2025 Presidential Lanae Miranda, She has more than 12 years of writing experience, focused on technology, travel, family and finance. Fact checked by kirsten rohrs schmitt.

2025 Irs Tax Brackets Married Filing Jointly Cammi Rhiamon, This is done to account for inflation. The personal exemption for 2025 remains at $0.

Federal 2025 Tax Rates Image to u, We’ve got you covered — and there’s actually some good news, thanks to. Fact checked by kirsten rohrs schmitt.

What Is The Federal Tax Bracket For 2025 Amata Bethina, Following are the federal tax tables and how to make sense of. Fact checked by kirsten rohrs schmitt.

Federal Married Tax Brackets 2025 Davina Carlene, Some states have a progressive. Say, have you ever wondered what the tax brackets are for the 2025 tax year?

Federal Tax Brackets 2025 Single Rubi Angelika, We’ve got you covered — and there’s actually some good news, thanks to. She has more than 12 years of writing experience, focused on technology, travel, family and finance.

When Does Tax Filing Start 2025 2025 JWG, The personal exemption for 2025 remains at $0. Taxpayers, while each state sets its own brackets.

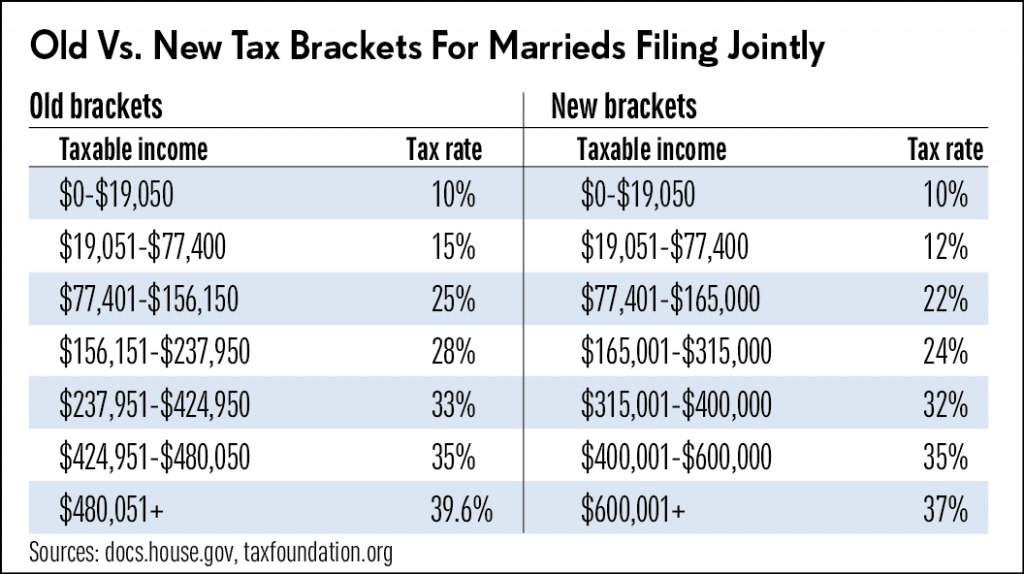

2018 Tax Rates Do You Know Your New Tax Bracket? — Freidel, For the 2025 tax year, the adjusted gross income (agi) amount for joint filers to determine the reduction in the lifetime learning credit is $160,000; For tax years 2025 and.

Irs Tax Brackets 2025 Head Of Household Eleen Harriot, The federal income tax’s progressive nature causes the marginal tax rate to increase as your taxable income increases. The personal exemption for 2025 remains at $0.

Irs Withholding Rates 2025 Federal Withholding Tables 2025, You pay the higher rate only on the part that's in the new tax bracket. We’ve got you covered — and there’s actually some good news, thanks to.

+more all taxes filing for free best tax software best tax software for small businesses tax refunds tax brackets tax tips taxes by state tax payment.

The federal income tax’s progressive nature causes the marginal tax rate to increase as your taxable income increases.